Teach Your Algorithm To Say “No” — Before Your Balance Sheet Does

A practical guide to deploying a 23‑input neural network that predicts credit‑card defaults with executive‑level clarity.

You can view the complete code including the dataset used on GitHub.

1. From Intuition To Evidence‑Based Risk Decisions

Traditional underwriting relies on experience and instinct—valuable, but fallible.

An Artificial Neural Network (ANN) introduces a disciplined, data‑driven second opinion that operates continuously and improves with every new record. The result: sharper risk assessment, steadier earnings.

2. Neural Networks In Plain English

An ANN functions like a multi‑tiered advisory committee:

- Input layer – 23 customer attributes enter the model.

- Hidden layers – variables interact, revealing subtle patterns.

- Output layer – a single neuron applies a sigmoid activation function and returns a probability between 0 and 1:“0.84 → 84 % likelihood of default next month.”

This probability enables precise, policy‑aligned actions—adjusting limits, revising terms, or initiating early engagement.

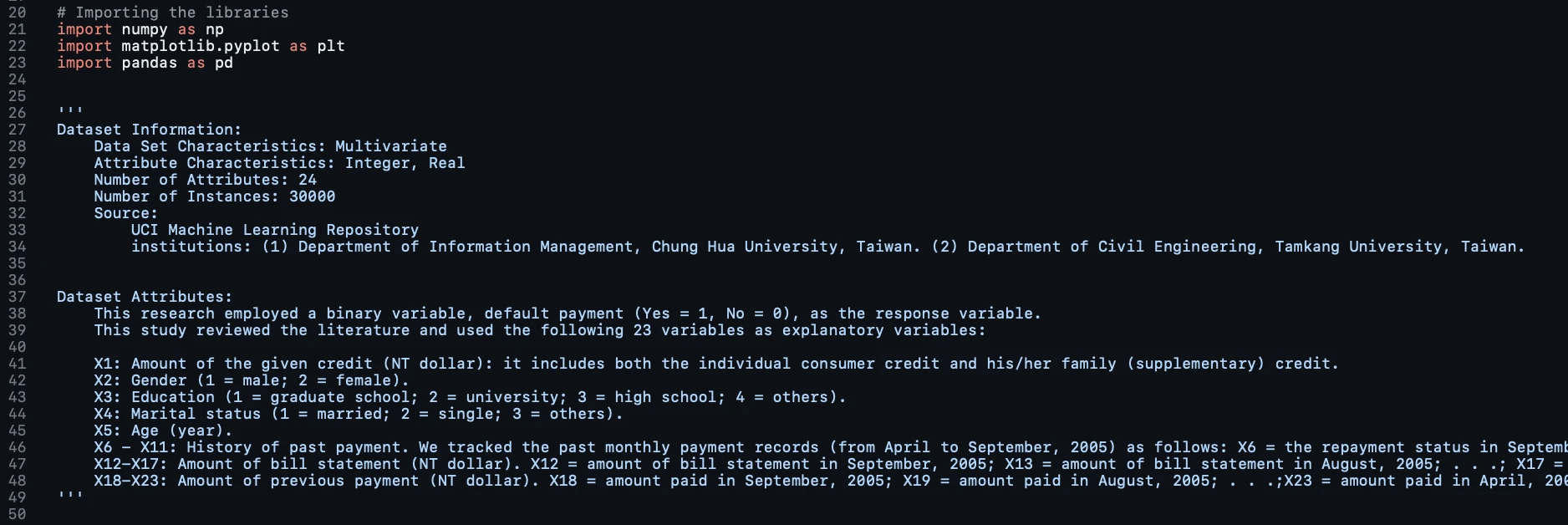

3. The Dataset: 30 000 Customers, 24 Variables Each

| Category | Examples | Purpose |

|---|---|---|

| Credit profile | Credit limit, bill amounts | Quantifies exposure |

| Demographics | Age, marital status | Contextualizes risk |

| Payment history | Six months of on‑time / late indicators | Captures behavioural trends |

Source: UCI Machine‑Learning Repository. Clean, complete, and representative of real‑world credit portfolios.

4. From Raw Data To Deployed Model

- Preparation

- Split 80 % training / 20 % testing.

- Scale features via StandardScaler to ensure equal influence.

- Architecture & Compilation

from keras.models import Sequential

from keras.layers import Dense

model = Sequential([

Dense(12, activation='relu', input_dim=23, kernel_initializer='uniform'),

Dense(12, activation='relu', kernel_initializer='uniform'),

Dense(1, activation='sigmoid', kernel_initializer='uniform')

])

model.compile(optimizer='adam',

loss='binary_crossentropy',

metrics=['accuracy'])- Training

- batch_size=10, epochs=100.

- Converges to ~82 % accuracy on unseen data.

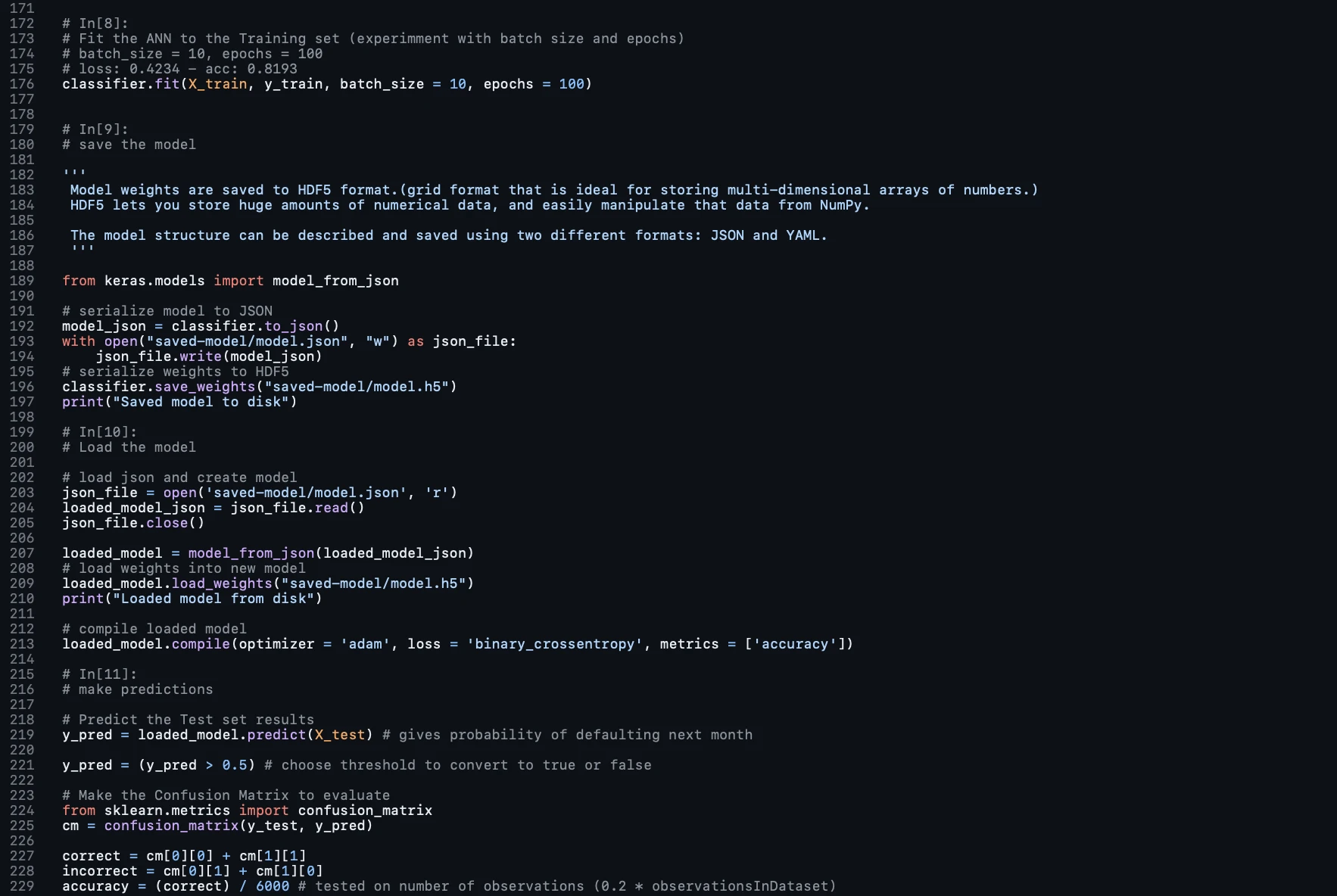

- Operationalization

- Serialize architecture (JSON) and weights (HDF5).

- Load the model in production for real‑time scoring or scheduled batch runs.

5. Executive‑Level Benefits

| Capability | Impact |

|---|---|

| Customer‑level probability scores | Prioritise collections, adjust credit lines, or offer counselling programs. |

| Continuous learning | Model retrains with new data, maintaining relevance as economic conditions shift. |

| Explainability tools | SHAP or feature‑importance plots clarify which variables drive risk, supporting regulatory compliance. |

6. Beyond Credit Risk

The same workflow underpins:

- Fraud detection – classify anomalous transaction patterns.

- Customer churn forecasting – pre‑empt attrition with targeted offers.

- Supply‑chain optimization – anticipate delays and adjust logistics accordingly.

Once the methodology is in place – prepare ➜ model ➜ deploy – your organization can apply it wherever data accumulates and decisions carry financial weight.

7. Next Steps

- Clone the GitHub repository and align the data schema with your core systems.

- Pilot the model on a historical sample to quantify uplift versus current scoring.

- Integrate into decision‑support dashboards and set a schedule for periodic retraining.

By embedding evidence‑based probability estimates into credit policy, leadership shifts from reactive loss control to proactive portfolio optimization – without adding manual overhead.

Accurate forecasts, disciplined decisions, improved stability. That’s the promise of a well‑engineered neural network in modern finance.